Contents

How to Plan Buying a House

Introduction

For most people, buying a first house is a milestone event in life and represents a major financial decision. In this project, we analyze the mathematics of three factors involved in buying a home: salaries, investments, and mortgages. As an example of our theory, we provide the scenario of a recent computer science graduate living and working in Denver, Colorado, who is planning to buy a house in 5 years.

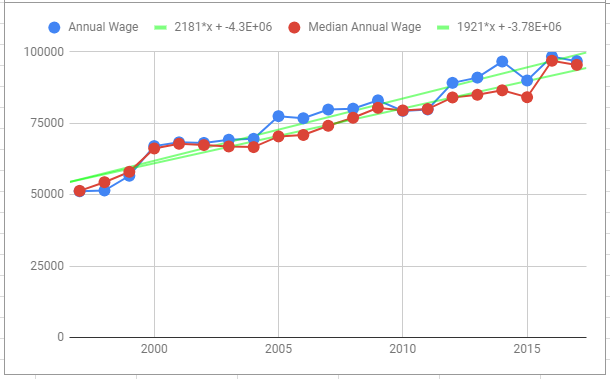

Salary

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Salary | 97,477.48 | 99,398,08 | 101,318,67 | 103,239,27 | 105,159.87 |

Investments

There are several types of investment opportunities available. We plan to invest 10% of the salary into investments following the project statement. Types of investments we considered included:

- Deferred Anuity: A deferred anuity is a retirement savings that enables one to <ref name="test">Link text, additional text.</ref>

- Savings Account:

- Fixed CD: A CD pays a fixed interest rate that is generally higher than a savings account, with the penalty that the money cannot be taken out for a period, generally five years.

- Money Market:

- Variable CD:

| Company | APY | Maximum years | Minimum for APY |

|---|---|---|---|

| Synchrony | 3.10 | 5 | 2000 |

| Citizens | 3.15 | 5 | 5000 |

| Capital One | 3.10 | 5 | 0 |

Mortgages

A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house.

Conclusion

<references><references/>