| (12 intermediate revisions by 3 users not shown) | |||

| Line 8: | Line 8: | ||

==== Salary ==== | ==== Salary ==== | ||

| + | |||

| + | To determine the projected salary in 2023, we used historical data of salaries for Computer Programmers in Denver, CO from 1997-2017. | ||

| + | |||

| + | [[File:AnnualMedianWage.png|400px|thumbnail]] | ||

{| border="1" class="wikitable" | {| border="1" class="wikitable" | ||

| Line 25: | Line 29: | ||

| 105,159.87 | | 105,159.87 | ||

|- | |- | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| − | [[File: | + | These projections account for average raises and CPI because previous patterns will be repeated in the future. To ensure that this was true, we compared the increase of the median hourly wage per year to the increase of the CPI per year and found that the increase for the wage was ~1 while the CPI slope was ~0.998, thus showing us that they increase at a similar rate. |

| + | [[File:IncreaseWageVsCPI.png|400px|thumbnail]] | ||

| + | |||

| + | A realistic monthly salary starting out in 2019 would be $8,123.12, which would be $97,477.48 annually. After five years, this value is projected to increase up to $105,159.87 in 2023. | ||

==== Investments ==== | ==== Investments ==== | ||

| Line 44: | Line 45: | ||

* '''Money Market''': A money market is an investment fund in the stock market, with the risks and rewards of stock investment. | * '''Money Market''': A money market is an investment fund in the stock market, with the risks and rewards of stock investment. | ||

| − | + | Due to our needs for a short-term, low risk investment, we decided CD's are the best investment. This table shows the interest rates on CD’s from various lenders. | |

{| border="1" class="wikitable" | {| border="1" class="wikitable" | ||

| Line 72: | Line 73: | ||

We are choosing Goldman Sachs because it has the highest APY (Annual Percentage Yield) with the lowest minimum for APY. We need at least $500 in order to start a CD account with Goldman Sachs, so we can begin investing after our first month. | We are choosing Goldman Sachs because it has the highest APY (Annual Percentage Yield) with the lowest minimum for APY. We need at least $500 in order to start a CD account with Goldman Sachs, so we can begin investing after our first month. | ||

Additionally, most CDs only allow a one-time addition of funds into the account. To overcome this, we will be using a CD Ladder strategy. This involves creating multiple short-term (12 month) CDs so that we can combine our savings over the course of the year with our profits from the previous year’s CD. We will save the rest of our money in a Savings account with an interest rate of 2%. Each Saving Account value is based off of saving 10% of our monthly paycheck and placing it into the savings account. Each CD value is based off of a 12 month CD with Goldman Sachs at 3.15 APY. The values also take into account taxes based off of 20% at the federal level and 7% at state. | Additionally, most CDs only allow a one-time addition of funds into the account. To overcome this, we will be using a CD Ladder strategy. This involves creating multiple short-term (12 month) CDs so that we can combine our savings over the course of the year with our profits from the previous year’s CD. We will save the rest of our money in a Savings account with an interest rate of 2%. Each Saving Account value is based off of saving 10% of our monthly paycheck and placing it into the savings account. Each CD value is based off of a 12 month CD with Goldman Sachs at 3.15 APY. The values also take into account taxes based off of 20% at the federal level and 7% at state. | ||

| + | |||

| + | First, we compute the paycheck after taxes. From [https://smartasset.com/taxes/colorado-paycheck-calculator#1pu5Hvnuyd this paycheck calculator], we find that the combined tax rate in Colorado is 24.84%. The monthly take-home pay is 1/12 of the yearly salary. | ||

| + | |||

| + | Pay = Salary / 12 * (1 - 0.2484) | ||

| + | |||

| + | 10% of this amount will be invested each year. Our plan is to deposit the monthly take home pay into a savings account, and at the end of each year, reinvest into a CD. Using [https://money.cnn.com/calculator/pf/moneygrow/index.html this savings interest calulator], we find the total in the savings account at the end of the year, and these numbers are illustrated in the second row of the table. The first row of the table represents the cumulative amounts invested in CD’s, and was computed with [https://www.bankrate.com/calculators/savings/bank-cd-calculator.aspx this CD calculator]. Each year, we have to subtract 27% of this income due to state and federal taxes. | ||

| Line 107: | Line 114: | ||

A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house. | A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house. | ||

| − | |||

| − | |||

There are two main factors to look at when considering how expensive of a house you can afford. How much you have saved for a down payment, and your monthly income for paying the mortgage costs. First we’ll look at how a down payment can affect it. | There are two main factors to look at when considering how expensive of a house you can afford. How much you have saved for a down payment, and your monthly income for paying the mortgage costs. First we’ll look at how a down payment can affect it. | ||

| Line 130: | Line 135: | ||

The amount we calculated in the savings section for a down payment was $38,966 which gives us $259,773.33 for the total cost of the house. Also, since our Down payment would be less than 20% of the value of the house, we can see that PMI would be required for our mortgage. | The amount we calculated in the savings section for a down payment was $38,966 which gives us $259,773.33 for the total cost of the house. Also, since our Down payment would be less than 20% of the value of the house, we can see that PMI would be required for our mortgage. | ||

| − | Secondly, one must consider the amount that they will be paying monthly on their mortgage. A good rule of thumb is not to be spending more than 28% of your monthly income on your housing costs. Since we determined we would have $ | + | Secondly, one must consider the amount that they will be paying monthly on their mortgage. A good rule of thumb is not to be spending more than 28% of your monthly income on your housing costs. Since we determined we would have $6,242 per month in part 2, that would give us $1747.76 available for monthly mortgage payments. |

Using these numbers which were calculated in parts 1 and 2, the next step is to consider the different types of mortgages available, and which is the best suited for the situation. There are two main types of mortgages: | Using these numbers which were calculated in parts 1 and 2, the next step is to consider the different types of mortgages available, and which is the best suited for the situation. There are two main types of mortgages: | ||

| Line 136: | Line 141: | ||

*'''Fixed Rate Mortgage''': A mortgage with a fixed duration, typically between 15-30 years, and a fixed interest rate | *'''Fixed Rate Mortgage''': A mortgage with a fixed duration, typically between 15-30 years, and a fixed interest rate | ||

| − | *'''Adjustable Rate Mortgage (ARM)''': | + | *'''Adjustable Rate Mortgage (ARM)''': This is usually defined with a period of time where the interest rate is fixed, and an interval for how often after that the interest rate is updated. A common type of ARM is a 5/1 ARM. This means that the interest rate is fixed for 5 years, and then it is updated every year after that based on an index, or market benchmark. |

| − | + | A fixed rate mortgage will generally have a higher initial interest rate, but it will remain constant throughout the remainder of the mortgage. Additionally, a shorter duration on a mortgage generally allows for a lower interest rate. We considered three different mortgages, a 15 year fixed mortgage, a 30 year fixed mortgage, and a 5/1 ARM. | |

| − | + | ||

| − | + | ||

| + | {| border="1" class="wikitable" | ||

| + | |- | ||

| + | ! Mortgage Type | ||

| + | ! Lender | ||

| + | ! Interest Rate | ||

| + | ! Monthly Payment | ||

| + | |- | ||

| + | | 30 Year Fixed Rate | ||

| + | | Ally Bank | ||

| + | | 4.875% | ||

| + | | $1,168/Month | ||

| + | |- | ||

| + | | 15 Year Fixed Rate | ||

| + | | CITI Bank | ||

| + | | 4.438% | ||

| + | | $1,682/Month | ||

| + | |- | ||

| + | | 5/1 ARM | ||

| + | | Consumer Direct Mortgage | ||

| + | | 4.250 % | ||

| + | | $1,086/Month | ||

| + | |- | ||

| + | |} | ||

== Conclusion == | == Conclusion == | ||

| + | We decided that the best option was to go with the 15 Year Fixed Rate mortgage from CITI Bank. It has the highest monthly payment, but it is less than 28% of our monthly post-tax income. In addition, getting a shorter term mortgage is cheaper in the long run, because it allows us to get a lower interest rate, and we will be paying interest on the mortgage for less time. The 5/1 ARM mortgage did have a lower initial rate, but unlike the Fixed Plans, the interest rate would go up with inflation, and could result in us paying more. | ||

== References == | == References == | ||

| − | + | #[https://www.bls.gov/oes/tables.htm Bureau of Labor Statistics: Salaries for Computer Programmers in Denver, CO 1997-2017] | |

| + | #[https://data.bls.gov/pdq/SurveyOutputServlet?data_tool=dropmap&series_id=CUURS48BSA0,CUUSS48BSA0 Bureau of Labor Statistics: CPI in Denver, CO 1964-2017] | ||

#[https://www.payscale.com/research/US/Job=Software_Engineer/Salary/6afda229/Entry-Level-Denver-CO Avg salary of junior software engineer in Denver] | #[https://www.payscale.com/research/US/Job=Software_Engineer/Salary/6afda229/Entry-Level-Denver-CO Avg salary of junior software engineer in Denver] | ||

#[https://smartasset.com/taxes/colorado-paycheck-calculator#1pu5Hvnuyd Paycheck calculator] | #[https://smartasset.com/taxes/colorado-paycheck-calculator#1pu5Hvnuyd Paycheck calculator] | ||

| Line 158: | Line 186: | ||

# [https://www.thebalance.com/all-about-deferred-annuities-2389020 Deferred Annuities] | # [https://www.thebalance.com/all-about-deferred-annuities-2389020 Deferred Annuities] | ||

# [http://www.finra.org/investors/types-investments Various Types of Investments] | # [http://www.finra.org/investors/types-investments Various Types of Investments] | ||

| − | # [https://www.trulia.com/mortgage-rates/Columbine,CO/?city=Littleton&state_code=CO&auto=true&zip=80123&value=264266&down=39640&skip_interstitial=true&va=false&loantype=purchase&cscore=740-759#request=ZR-BYWFYGHG] | + | # [https://www.trulia.com/mortgage-rates/Columbine,CO/?city=Littleton&state_code=CO&auto=true&zip=80123&value=264266&down=39640&skip_interstitial=true&va=false&loantype=purchase&cscore=740-759#request=ZR-BYWFYGHG Mortgage Rates] |

Latest revision as of 18:52, 2 December 2018

Contents

How to Plan Buying a House

Introduction

For most people, buying a first house is a milestone event in life and represents a major financial decision. In this project, we analyze the mathematics of three factors involved in buying a home: salaries, investments, and mortgages. As an example of our theory, we provide the scenario of a recent computer science graduate living and working in Denver, Colorado, who is planning to buy a house in 5 years.

Salary

To determine the projected salary in 2023, we used historical data of salaries for Computer Programmers in Denver, CO from 1997-2017.

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Gross Salary | 97,477.48 | 99,398.08 | 101,318.67 | 103,239.27 | 105,159.87 |

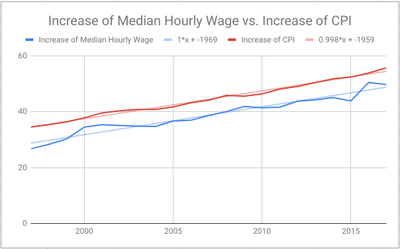

These projections account for average raises and CPI because previous patterns will be repeated in the future. To ensure that this was true, we compared the increase of the median hourly wage per year to the increase of the CPI per year and found that the increase for the wage was ~1 while the CPI slope was ~0.998, thus showing us that they increase at a similar rate.

A realistic monthly salary starting out in 2019 would be $8,123.12, which would be $97,477.48 annually. After five years, this value is projected to increase up to $105,159.87 in 2023.

Investments

There are several types of investment opportunities available. We plan to invest 10% of the salary into investments following the project statement. Types of investments we considered include:

- Savings Account: The standard bank savings account. Unfortunately the interest rates are not as high as other options.

- Certificate of Deposit (CD): A CD pays a fixed interest rate that is generally higher than a savings account, with the penalty that the money cannot be taken out for a period, generally five years.

- Deferred Annuity: A deferred annuity is a retirement savings that enables one to pay money for a fixed income after retirement, similar to a pension plan. However, there is a large penalty for withdrawal of any money before age 59.5. Since we plan to invest for five years, this is not a good choice.

- Money Market: A money market is an investment fund in the stock market, with the risks and rewards of stock investment.

Due to our needs for a short-term, low risk investment, we decided CD's are the best investment. This table shows the interest rates on CD’s from various lenders.

| Company | APY | Maximum years | Minimum for APY |

|---|---|---|---|

| Goldman Sachs | 3.15 | 5 | 500 |

| Citizens | 3.15 | 5 | 5000 |

| Capital One | 3.10 | 5 | 0 |

We are choosing Goldman Sachs because it has the highest APY (Annual Percentage Yield) with the lowest minimum for APY. We need at least $500 in order to start a CD account with Goldman Sachs, so we can begin investing after our first month. Additionally, most CDs only allow a one-time addition of funds into the account. To overcome this, we will be using a CD Ladder strategy. This involves creating multiple short-term (12 month) CDs so that we can combine our savings over the course of the year with our profits from the previous year’s CD. We will save the rest of our money in a Savings account with an interest rate of 2%. Each Saving Account value is based off of saving 10% of our monthly paycheck and placing it into the savings account. Each CD value is based off of a 12 month CD with Goldman Sachs at 3.15 APY. The values also take into account taxes based off of 20% at the federal level and 7% at state.

First, we compute the paycheck after taxes. From this paycheck calculator, we find that the combined tax rate in Colorado is 24.84%. The monthly take-home pay is 1/12 of the yearly salary.

Pay = Salary / 12 * (1 - 0.2484)

10% of this amount will be invested each year. Our plan is to deposit the monthly take home pay into a savings account, and at the end of each year, reinvest into a CD. Using this savings interest calulator, we find the total in the savings account at the end of the year, and these numbers are illustrated in the second row of the table. The first row of the table represents the cumulative amounts invested in CD’s, and was computed with this CD calculator. Each year, we have to subtract 27% of this income due to state and federal taxes.

| Initial | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|---|

| CD | $583.40 | $596.54 | $7838.06 | $15,371.58 | $23,266.56 | $31,407.54 |

| Savings Account | $0 | $7065.00 | $7188.00 | $7372.00 | $7435.00 | $7559.00 |

Our final total is $38966.54.

Mortgages

A mortgage is a special type of loan between the bank and you for a house. The loan works by providing the house as collateral, meaning that if you fail to pay off the loan, the bank takes your house. A typical mortgage starts with a "downpayment" of at least 3.5% of the houses value. If the house costs $100,000, then before receiving the loan one must pay at least $100,000 * 0.035 = $3500 first. The bank then pays the remainder of the house cost to the previous owners of the house. Over time, the loan works by paying both the interest and the principal - the original $100,000 cost of the house.

There are two main factors to look at when considering how expensive of a house you can afford. How much you have saved for a down payment, and your monthly income for paying the mortgage costs. First we’ll look at how a down payment can affect it.

One of the first things to consider for a down payment is whether you’ll need to be paying for private mortgage insurance (PMI). While Federal Housing Administration only requires that a down payment account for 3.5% of the value of the house, any mortgage for more than 80% of the houses value must be protected by private mortgage insurance.

P = principle (Total cost of house) D = down payment

if P * .2 < D PMI is required

This protects the bank, or other lender in case the person who acquired the loan is no longer able to make the mortgage payments. Once you’ve paid down a certain percentage of the principle, and built up enough equity on the home, it is possible to become eligible to no longer make PMI payments part way through a mortgage.

The down payment of the house can also affect the interest rate that one gets on their mortgage. Generally, the larger the down payment, the lower the interest rate. This can also be affected by other factors, such as credit score.

Our Down payment is supposed to account for 15% of the houses value, so we can use the amount we have saved after five years to determine the most expensive house we can buy, based on our down payment with the following formula:

P = D / .15

The amount we calculated in the savings section for a down payment was $38,966 which gives us $259,773.33 for the total cost of the house. Also, since our Down payment would be less than 20% of the value of the house, we can see that PMI would be required for our mortgage.

Secondly, one must consider the amount that they will be paying monthly on their mortgage. A good rule of thumb is not to be spending more than 28% of your monthly income on your housing costs. Since we determined we would have $6,242 per month in part 2, that would give us $1747.76 available for monthly mortgage payments.

Using these numbers which were calculated in parts 1 and 2, the next step is to consider the different types of mortgages available, and which is the best suited for the situation. There are two main types of mortgages:

- Fixed Rate Mortgage: A mortgage with a fixed duration, typically between 15-30 years, and a fixed interest rate

- Adjustable Rate Mortgage (ARM): This is usually defined with a period of time where the interest rate is fixed, and an interval for how often after that the interest rate is updated. A common type of ARM is a 5/1 ARM. This means that the interest rate is fixed for 5 years, and then it is updated every year after that based on an index, or market benchmark.

A fixed rate mortgage will generally have a higher initial interest rate, but it will remain constant throughout the remainder of the mortgage. Additionally, a shorter duration on a mortgage generally allows for a lower interest rate. We considered three different mortgages, a 15 year fixed mortgage, a 30 year fixed mortgage, and a 5/1 ARM.

| Mortgage Type | Lender | Interest Rate | Monthly Payment |

|---|---|---|---|

| 30 Year Fixed Rate | Ally Bank | 4.875% | $1,168/Month |

| 15 Year Fixed Rate | CITI Bank | 4.438% | $1,682/Month |

| 5/1 ARM | Consumer Direct Mortgage | 4.250 % | $1,086/Month |

Conclusion

We decided that the best option was to go with the 15 Year Fixed Rate mortgage from CITI Bank. It has the highest monthly payment, but it is less than 28% of our monthly post-tax income. In addition, getting a shorter term mortgage is cheaper in the long run, because it allows us to get a lower interest rate, and we will be paying interest on the mortgage for less time. The 5/1 ARM mortgage did have a lower initial rate, but unlike the Fixed Plans, the interest rate would go up with inflation, and could result in us paying more.

References

- Bureau of Labor Statistics: Salaries for Computer Programmers in Denver, CO 1997-2017

- Bureau of Labor Statistics: CPI in Denver, CO 1964-2017

- Avg salary of junior software engineer in Denver

- Paycheck calculator

- Average Down Payment information

- Ideal income percentage to be spending on housing

- Private Mortgage Insurance Info

- Down Payment affecting monthly payments info

- Savings Interest Calulator

- Certificate of Deposit

- Deferred Annuities

- Various Types of Investments

- Mortgage Rates